American Express is a major card issuer in Australia and is a popular choice for point hackers looking for high sign-up bonuses, great ongoing offers, high points earn, and premium customer service. The trade-off? Amex does charge higher fees to merchants, so acceptance is lower than Visa or Mastercard. However, acceptance has improved greatly over the last few years.

Most major retailers and a good selection of smaller independent shops do accept American Express cards. Many readers will also dual-wield an Amex and either a points-earning Visa or Mastercard to ensure no purchases get missed.

In Australia, American Express Card Members are able to earn points in three programs depending on the card type — American Express Membership Rewards, Qantas Frequent Flyer and Velocity Frequent Flyer.

Our table below will show the highest-earning American Express cards on offer, including the direct-earn rate for Qantas and Velocity Cards compared to the effective earn rate of the Membership Rewards cards.

The highest-earning American Express credit cards

| Card | Offer | Earn Rate per $1 | Points Cap | Annual Fee | Our Guide |

|---|---|---|---|---|

| Qantas Frequent Flyer | ||||

American Express Qantas Business Rewards Card ↓ | 1.25 Qantas points on general spend 2.25 Qantas points with Qantas 0.5 Qantas Point per $1 on government spend | uncapped | $450 p.a. | Read Here |

Qantas American Express Ultimate ↓ | 1.25 Qantas Points on general spend including utilities and telecom 2.25 Qantas Points with Qantas 0.5 Qantas Point per $1 on government spend | uncapped | $450 p.a. | Read Here |

American Express Platinum Card ↓ | 1.125 Qantas Points on all eligible spend, and 0.5 Qantas Point on spend at government bodies (Effective earn rate when transferred from MR Ascent Premium Points) | uncapped | $1,450 p.a. | Read Here |

American Express Platinum Business Card ↓ | 1.125 Qantas Points on all eligible spend, and 0.5 Qantas Point on spend at government bodies (Effective earn rate when transferred from MR Ascent Premium Points) | uncapped | $1,750 p.a. | Read Here |

Qantas American Express Premium ↓ | 1 Qantas Point on general spend including utilities and telecom 2 Qantas Points with Qantas 0.5 Qantas Point per $1 on government spend | uncapped | $249 p.a. | Read Here |

American Express Qantas Discovery | 0.75 Qantas Point on general spend, 1.75 Qantas Points with Qantas 0.5 Qantas Point per $1 on government spend | uncapped | $0 p.a. | Read Here |

| Velocity Frequent Flyer - Direct Earn | ||||

American Express Velocity Platinum ↓ | 1.25 Velocity points on eligible spend 2.25 Velocity Points with Virgin Australia 0.5 Velocity Points on spend at government bodies | uncapped | $375 | Read Here |

American Express Velocity Escape | 0.75 Velocity Points on general spend 1.75 Velocity Points with Virgin Australia 0.5 Velocity Points on spend at government bodies | uncapped | $0 | Read Here |

| Membership Rewards | ||||

American Express Platinum Card ↓ | 2.25 Amex MR Points on all eligible spend, and 1 MR Point on spend at government bodies | uncapped | $1,450 p.a. | Read Here |

American Express Platinum Business Card ↓ | 2.25 Amex MR Points on all eligible spend, and 1 MR Point on spend at government bodies | uncapped | $1,750 p.a. | Read Here |

American Express Explorer ↓ | 2 Amex MR points on eligible spend, 1 Amex MR point on government bodies | uncapped | $395 p.a. | Read Here |

American Express Business Explorer ↓ | 2 Amex MR points on eligible spend, 1 Amex MR point on government bodies | uncapped | $149 p.a. | Read Here |

American Express Platinum Edge ↓ | 1 Amex MR point on eligible spend including utilities and ATO 2 points on overseas spend 3 points at supermarkets and petrol stations | uncapped | $195 p.a. | Read Here |

How do I use this list?

For all the cards and offers listed on this page, we are looking at two things:

- ‘direct earn rates’ of cards that earn Qantas or Velocity Points on eligible spend, or

- ‘effective earn rates’ of cards that earn points into the Membership Rewards flexible rewards program, but later allow transfers to other frequent flyer programs at varying rates

The ‘effective earn rate’ is an important number that standardises the number of points you could earn with a Membership Rewards card. For example, the Platinum Charge card earns 2.25 Membership Rewards points per $1, but its effective earn rate is 1.125 points per $1 because this is the number of points or miles you would end up in with Qantas, Velocity, Asia Miles, KrisFlyer and more.

The numbers in this table are already calculated as ‘effective earn rates’, which means you can more easily compare those cards to ‘direct earn’ Qantas and Velocity cards

What do I need to consider in an American Express credit card?

In addition to the card’s usual earn rates, you should also consider:

- Unique benefits offered, such as shopping perks, complimentary insurance, travel credits or free return domestic flights

- Any card sign-up bonuses for new users. Existing users usually have to go 18 months without holding an American Express product before being eligible for sign-up again

- Whether the places you usually shop at accept American Express, and if any surcharges apply

- Card annual fees and overall T&Cs

- Google and Apple Pay capabilities, which are becoming increasingly useful

A large signup bonus from American Express might be rewarding enough to help offset a lower earn rate or a higher annual fee on a card, so bear that in mind.

Each card offer and other information on this page should be up to date at the date of publication. However, please note that we update offers over time. If you need more information with comparing different cards, check out our overview table for detailed information on rewards.

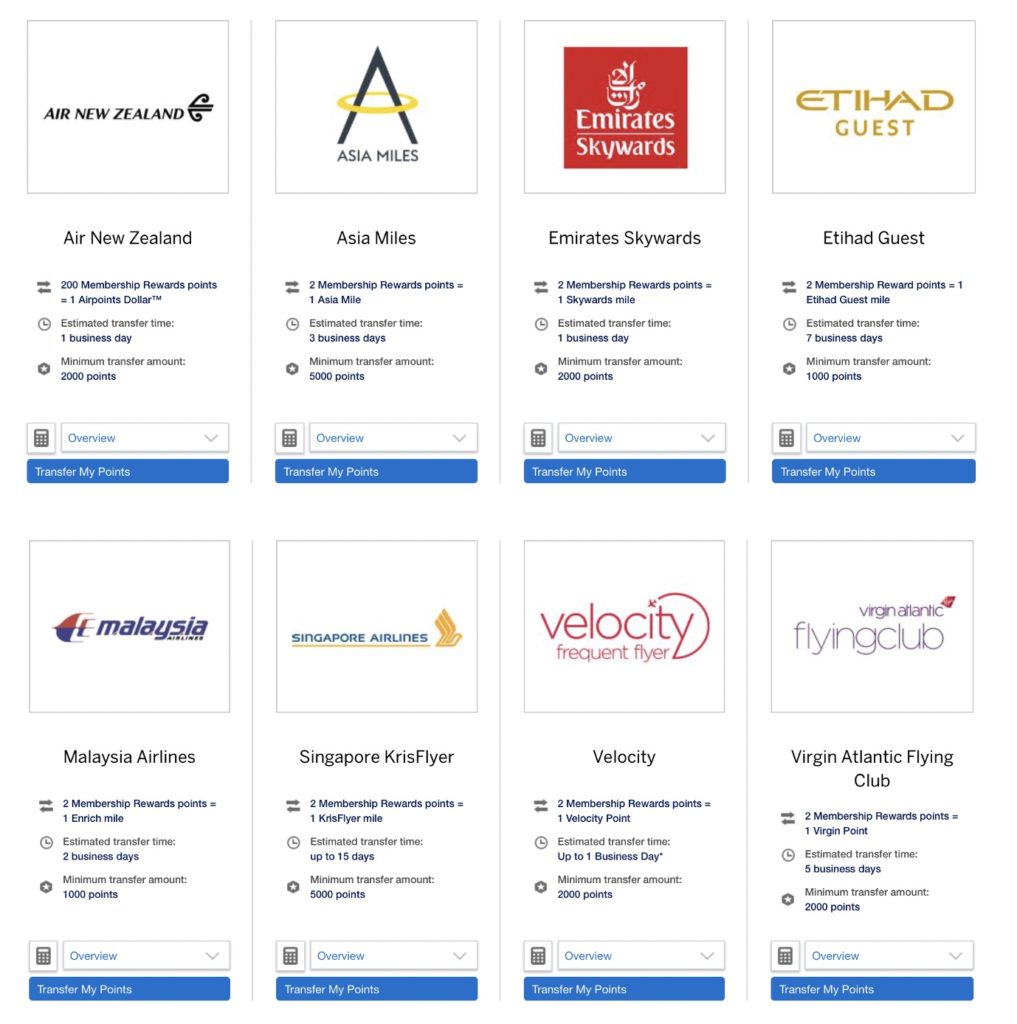

What are the Membership Rewards partners?

American Express Membership Rewards program is a flexible points program with many frequent flyer partners. In most cases, the transfer rate is 2 MR points for one frequent flyer point or mile. The airline transfer programs are:

- Qantas Frequent Flyer (limited cards only)

- Velocity Frequent Flyer

- Singapore Airlines KrisFlyer

- Asia Miles

- Emirates Skywards

- Etihad Guest

- Malaysia Airlines Enrich

- Virgin Atlantic Flying Club

- Air New Zealand Airpoints (200:1 transfer rate)

Our tables above show the effective earn rate from Membership Rewards cards to the aforementioned airline loyalty programs, except for Air New Zealand Airpoints which uses a different conversion rate.

Current deals for American Express credit cards

Qantas Frequent Flyer

Velocity Frequent Flyer

Membership Rewards

Summing up

The focus of this guide is to outline the highest-earning American Express credit cards out there on a per-dollar basis. The featured cards here tend to have higher earn rates or better sign-up bonuses at the moment, across a range of loyalty programs.

While American Express cards can be very rewarding, not as many merchants accept Amex worldwide. That’s why it could be beneficial to pair your American Express card with a points-earning Visa or Mastercard for greater rewards.

I spend plenty with supermarkets and enjoy the rewards but the PE basic spend earn rate of (effectively) half a Krisflyer mile per dollar is not great (and not as good as some non-Amex cards).